Car Allowance Taxable Malaysia

Since not all allowances are exempt you should consider this list of non-exempt allowancesi. Just like Benefits-in-Kind Perquisites are taxable from employment income.

72 cents per kilometre from 1 July 2020 for the 202021 and 202122 income years.

. The annual allowance for motor vehicles is available at the accelerated rate of 20 as compared to the rate of 14 for other plant or machinery. A typical car allowance may be reduced by 3040 after all these taxes. Income tax allowances and deductionsSpecial allowances and deductions available for an employee transport allowance of Rs 1600 per month are exempt from tax for an employee.

Expenses not wholly and exclusively incurred in the production of income domestic private or capital expenditure the company can claim capital allowance for capital expenditure incurred lease rentals for passenger cars exceeding rm50000 or rm100000 per car the latter amount being applicable to vehicles costing rm150000 or less which. These benefits are called benefits in kind BIK. Salary bonus allowances perquisites.

Travel allowances of up to RM6000 for petrol and tolls are granted tax-free if the vehicle used is not owned by the company. However as both the employer and the worker must pay FICAMedicare taxes the amount your employees actually get to keep from their car cash allowance is much lower. Any amount received more than Rs1600 is taxable.

Child care allowance for children up to 12 years of age Tax exempt up to RM 2400 per year. Fixed car allowanceis taxable income at both the state and federal levels. There are several tax rules governing how these benefits are valued and reported for tax purposes.

Sales Tax All 30 0 NIL 0 NIL 10 Notes. 22 Travelling allowances Travelling allowances of up to RM6000 for petrol and tolls are granted a tax exemption if the vehicle used is not under the ownership of the company. The amount will vary depending on your business.

Motorcar RM Fuel RM Up to 50000. And one should also be aware of exemptions granted in certain. DUTIES TAXES ON MOTOR VEHICLES A PASSENGER CARS INCLUDING STATION WAGONS SPORTS CARS AND RACING CARS CBU CKD CBU CKD IMPORT DUTY IMPORT DUTY LOCAL TAXES.

78 cents per kilometre from 1 July 2022 for the 202223 income year. This refers to the claims made by employees who are using their personal vehicle for official duties. 66 cents per kilometre for the 201718 201617 and 201516.

INCOME TAX ACCELERATED CAPITAL ALLOWANCE MACHINERY AND EQUIPMENT INCLUDING INFORMATION AND COMMUNICATION TECHNOLOGY EQUIPMENT RULES 2021 The normal annual capital allowance rate is 10 or 14 depending on type of assets however the Government has gazette new Rules deemed as accelerated. Or b outside Malaysia not exceeding one passage in any calendar year is limited to a maximum of RM3000. However there are exemptions.

Employment income is regarded as derived from Malaysia and subject to Malaysian tax where the employee. Consider what percentage of travel is required and how the reimbursement is set up. However the QE is restricted to RM100000 since it is a new non-commercial vehicle costing is not more than RM150000.

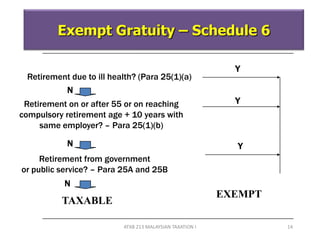

Certain allowances perquisites are exempted from tax. The payment you give is known as a company car allowance. Iii Service provided free or at a discount by the business of the employer to the employee his spouse and unmarried children.

Tax exempt up to RM2400 per year. Includes payment by the employer directly to the parking operator. Petrol allowance petrol card travelling allowance or toll payment or any combination.

Total amount paid by employer. Includes payment by the employer directly to the childcare provider. Petrol allowance petrol card travelling allowance or toll payment or any combination Tax exempt up to RM 6000 per year only if used for official duties.

Income Tax Act 1967 Schedule 3 stated clearly that the maximum qualifying expenditure for a private vehicle not licensed on a commercial basis is RM50000 RM100000 if the purchased vehicle is a new vehicle and its value is less than RM150000 this is why everybody believe register private vehicle under company name will save their tax. Cost of car when new RM Annual prescribed benefit. 23 Benefits in kind exemptions.

One company may offer a flat monthly allowance. Travelling allowance petrol allowance toll rate up to RM6000 annually Parking allowance Meal allowance Child care allowance of up to RM2400 annually Subsidies on interest for housing education car loans. More than RM 6000 may be claimed if records are kept for 7 years.

Parking rate or parking allowance. Generally non-cash benefits eg. MFN Most Favoured Nation rate ATIGA ASEAN Trade in Goods Agreement Updated.

Accommodation or motorcars provided by employers to their employees are treated as income of the employees. It is a fixed amount paid for employees vehicle expenses. Standard car allowance A fixed monthly car allowance is considered taxable income at federal and state levels.

68 cents per kilometre for 201819 and 201920. Both employee and employer must also pay FICAMedicare taxes on the allowance. These are the claims of employees who use their personal vehicle for official duties.

Tax exempt as long the amount is not unreasonable. You can claim a maximum of 5000 business kilometres per car. A within Malaysia including meals and accomodation for travel not exceeding 3 times in any calendar year.

Costs include wear and tear fuel and other expenses that they incur. 1 Sept 2018 MALAYSIA.

Myanmar Airways International Frequent Flyer Program Malaysia Airlines Myanmar

0 Response to "Car Allowance Taxable Malaysia"

Post a Comment